OUR HOURS ARE MON- FRI 8 AM to 4 PM Call us @ 260-432-2220

INTIME How to Setup Individual Account

(This will enable you to pay Indiana taxes online, pay estimated taxes online and give POA Access to

1.) Go to.: https://intime.dor.in.gov/eServices/_/#12

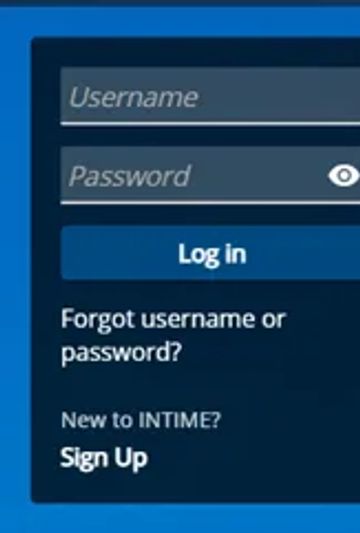

2.) Click on Sign up (see image to the left for example.

3.) Create a Username (You can only create a username if you have previously filed a tax return with Indiana. Click Create a Username.

4.) Select Individual and then select Next (See Image Below)

5.) Enter Social Security Number and Last Name, Then Click Next.

6.) You will then need to verify your account with one of the the following:

A. Letter ID (This would be a letter sent to you by the Indiana Department of Revenue

B. Refund Amount on your Last Tax Return

C. Return Line Item

Note: You will need to have your last tax return you filed in front of you to setup your account. It is easiest to use either your refund amount or Return Line Item which will be either a Line Item they ask for (example Line 1 or Refund Amount)

7.) If you answer successfully it will ask you to setup a username and password.

8.) Once you setup your account, it will have you setup a way to

ensure that when you login it is you, we recommend using your email or your phone, it will send a code to authenticate you. You will then need to authenticate your code.

9.) When you login you will see Summary. Click on Make a payment, Pay with bank account or Card. (If you pay with card they will charge a fee).

10.) Under the payment type, select the kind of payment. Either Estimated Payment or Return Payment.

11.) Be sure to enter in the correct routing and checking account number and the dates that you would like withdrawn.

***Once you have setup your INTIME Account, if you would like us to have POA Access, let us know and we can request it, then you would just need to login to your account and approve it.

This website uses cookies.

We use cookies to analyze website traffic and optimize your website experience. By accepting our use of cookies, your data will be aggregated with all other user data.